FDI attraction is perceived by many countries in transition as an important task. Such policy is based on the expectation that FDI will positively affect the economy, bring new technologies, open new markets, and improve management and administration.

The situation in Belarus is somewhat different: the FDI attraction is insignificant and mostly targeted to cover the balance-of-payments deficit. Other issues like production efficiency, technology or management innovations are marginalized.

With domestic investment sources shrinking and savings at home remaining low, the FDI role grows in importance. Alongside with bank loans, FDI can turn into the main investment source and an important tool to boost competitive capacity of the economy. However, the FDI effectiveness is still under question.

The study on this issue of the Belarusian economy was based on the aggregated sectoral level panel data collected and provided by the National Statistic Committee of the Republic of Belarus. The data covered the period over 2002 – 2009 and included the information about the industries’ performance. It contained the information about 21 industries, at that the manufacturing industry was divided into 9 sub industries

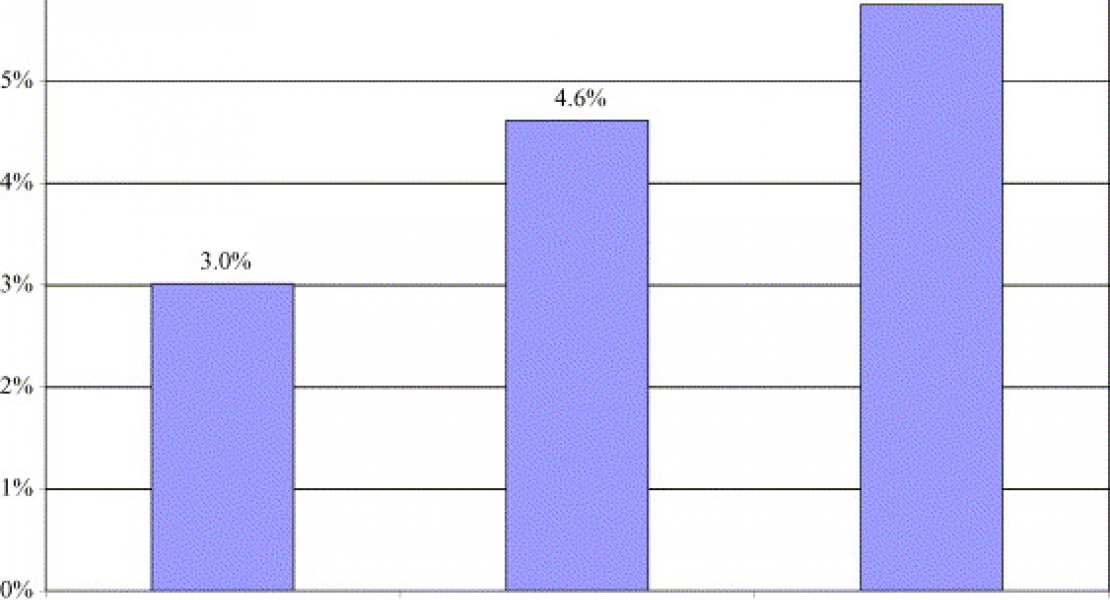

The research has not revealed any general FDI impact on economic productivity. Yet, disparity of the FDI effect across sectors proved significant.

Such industries as fuel, machinery, food, construction, real estate and IT gain from the FDI attraction. On the other hand ferrous metallurgy, construction materials construction, telecommunication and non-production materials services worsen their performance due to the foreign capital. Interestingly, FDI flows exert negative influence on forestry, contrary to the agriculture.

In general, the research findings suggest Belarus should consider a more consistent and cautious approach to the foreign capital attraction to all economic sectors and assess potential gains from the perspective of economic growth. Placing this issue under a more detailed scrutiny can bring about a policy of maximum profits by means of correct FDI attraction to various economic sectors. It could also result in better conditions for benefiting from foreign capital in sectors that are having no gains from it in the current institutional environment.

Read the full text ( in Russian ).